is new mexico tax friendly for retirees

The town ranks third among the best places to. There are more than 300000 retirees in New Mexico.

A Guide To The Best And Worst States To Retire In

New Mexico is moderately tax-friendly for retirees.

. Social Security and public pensions are exempt from taxation but the Aloha State taxes private pensions and income from retirement saving plans at rates of up to 11. Specifically victims of the fires and winds that began on April 5 2022 have until August 31 2022 to file and pay tax returns and payments due between April 5 and August 30. Then below the map link to more content about state taxes on retirees including our picks for the 10 most tax-friendly and the 10 least tax-friendly states for retirees.

Social Security retirement benefits are taxable in New Mexico but they are also partially deductible. For seniors age 65 or older there is an 8000 deduction on retirement income if the household adjusted gross income AGIis less than 28500 for single filers 51000 for married people filing. It ranks towards the middle of this list with a tax rate of 1760.

This effort has been a long time coming and I would like to recognize Governor Lujan Grisham for making it a priority for the session and signing it into law. However many lower-income seniors can qualify for a deduction that reduces this overall tax burden. And see what new State made it onto the list for 2021.

Hawaiis top rate of estate. Reduced Vehicle Registration Fees. 13 hours agoThe due date for quarterly payroll and excise tax returns normally due on May 2 and August 1 2022 are extended to August 31 for New Mexico wildfire and wind victims too.

Does New Mexico offer a tax break to retirees. First the bad news. Those whose income is less than 100000 single or 150000 married filing jointly will no longer have to pay state taxes on benefits.

55 Mean property tax rate as a percentage of mean home value. The IRS has granted victims of the recent New Mexico wildfires and straight-line winds more time to file various individual and business tax returns and make tax payments. New Mexico on Tuesday joined a growing number of states.

The Cost of Living Is Low. Silver City is a college town in western New Mexico. Flat 463 income tax rate.

The state is coming in at 6 due to it being quite tax friendly for retirees. See our Tax Map for. The state also offers a maximum 3000.

Retire smart and save money. Prescription drugs are still exempt. State Sales Tax Rate.

The exemption is 2500 for taxpayers under the age of 65. New Mexico is moderately tax-friendly for retirees. New Mexico is moderately tax-friendly for retirees.

Colorado one of the states that imposes at least some Social Security benefits is actually among the 10 most tax-friendly states for retirees. The elimination of income tax on Social Security in New Mexico is going to benefit retirees the many children being fostered by their grandparents and New Mexicos middle class said Sen. Compared to many other popular retirement states the cost of living in New Mexico is quite low.

House Bill 167 Tribe. Penalties on payroll. This applies to a lot of different factors such as housing transportation and groceries.

See which 8 States are the most tax friendly for retirees. Three main types of state taxesincome tax property tax and sales taxinteract to determine the most tax-friendly states if youre retired or youre about to retire. 323 on all income but Social Security benefits arent taxed.

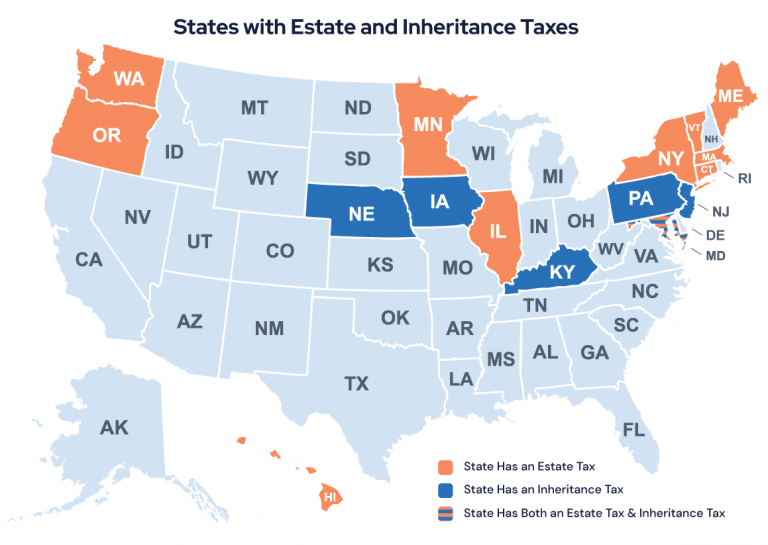

Its important to note that New Mexico does tax retirement income including Social Security. The exemption is 2500 for taxpayers under the age of 65. Estate and Inheritance Tax.

New Mexico is well known for its low costing of living which is 31 lower than the average in the United States. Thats why its best to weigh. Placitas located just north of Albuquerque has the lowest tax rate on this list at just 1610 so those looking for a city where they wont have to give too much to Uncle Sam can look here.

In this case the state is coming in at 6 due to it being quite. Moderate Partisan Bill Republican 13-3 Status. It ranks towards the middle of this list with a tax rate of 1760.

Depending on income level taxpayers 65 years of age or older may be eligible for a. Democrats said that if Social Security income tax was abolished the state would lose tens of millions of dollars. New Mexico is moderately tax-friendly for retirees.

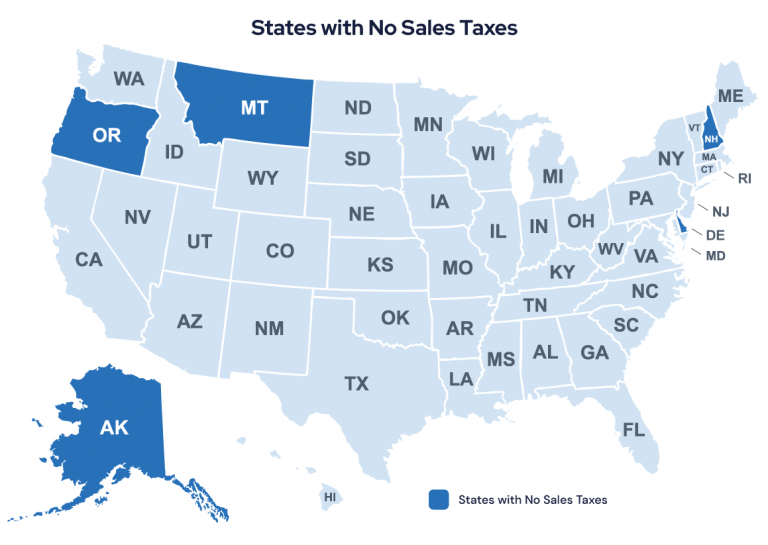

And groceries exempt in many other states are taxed at 4 not including applicable local taxes ouch. Tennessee has the nations highest combined state and local sales tax rate an average of 955. The document has moved here.

29 on income over 440600 for single filers and married filers of joint returns 4 5. California will tax you at 8 as of 2021 on income over 46394. Property tax exemption for seniors 65 and older or surviving spouses 50 of first 200000 in actual value exempt No estate or inheritance tax.

New Mexico taxes Social Security income although there is a deduction available for low-income taxpayers 65 or older of up to 8000.

The 10 Best Places To Retire In New Mexico In 2021 Newhomesource

The 10 Best Places To Retire In New Mexico In 2021 Newhomesource

11 Pros And Cons Of Retiring In New Mexico Retirepedia

State Tax Information For Military Members And Retirees Military Com

Mapsontheweb Infographic Map Map Sales Tax

11 Pros And Cons Of Retiring In New Mexico Retirepedia

New Mexico Retirement Tax Friendliness Smartasset

The 10 Best Places To Retire In New Mexico In 2021 Newhomesource

A Guide To The Best And Worst States To Retire In

Cryptocurrency Taxes What To Know For 2021 Money

The 10 Best Places To Retire In New Mexico In 2021 Newhomesource

The 10 Best Places To Retire In New Mexico In 2021 Newhomesource

A Guide To The Best And Worst States To Retire In

The 10 Best Places To Retire In New Mexico In 2021 Newhomesource

A Guide To The Best And Worst States To Retire In

How Tax Friendly Is Your State Moneygeek Moneygeek Com

States With Highest And Lowest Sales Tax Rates